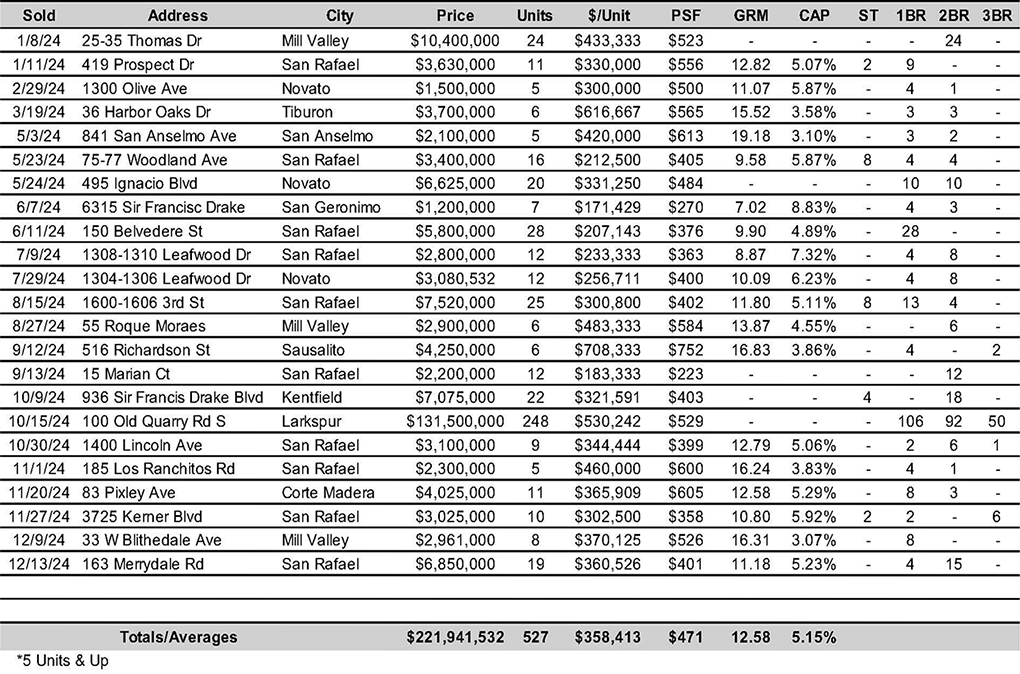

San Rafael – Marin County apartment sales volume increased 2.5 times the volume in the previous year from $62 million in 2023 to over $221 million in 2024. Investors waiting for lower prices and higher returns finally found them last year.

With higher mortgage rates and stricter lender underwriting, deals became creative with seller financing and first and secondary financing occurring in more than half of the closed sales. As prices softened, CAP rates increased year over year from a median of 4.63% in 2023 and moved to 5.15% in 2024.

With higher mortgage rates and stricter lender underwriting, deals became creative with seller financing and first and secondary financing occurring in more than half of the closed sales. As prices softened, CAP rates increased year over year from a median of 4.63% in 2023 and moved to 5.15% in 2024.

At the same time the median price per unit dropped from $380,000 in 2023 to $358,000 in 2024. The median gross rent multipliers also decreased from 14.21 to 12.58 year over year. Except for luxury Southern Marin apartment properties, with GRM’s from 15.5 to 16.8%, most of the closed sales volume was in San Rafael where properties turn over the most.

Pushing up the volume in the County was the sale of a 249-unit property in Larkspur at 100 Old Quarry Road which sold for $131 million in October of 2024. The remainder of the sales of 5 plus units were buildings from 5-22 units with most owners retiring from real estate management and either cashing out, carrying short term paper or exchanging into non-management intensive properties.

Even with the large increase in sales, many owners that listed their properties last year did not secure a buyer and plan to return to the market this year with their properties offered at a lower price.

I expect to see increasing inventory this year as longtime owners retire, even more creative deal making and lower prices to match the closed sales in 2024.

If you are planning on selling be aware that prices have already peaked, and we are on our way back down to lower prices that will yield better returns for the for the real estate investor.

Last year Marin County rents softened as the vacancy rate rose to 4.7% according to a recent Costar rental survey. The County population has declined by 1.2% year over year, as tenants moved back to San Francisco or moved out of state to seek cheaper housing.

Especially hard hit were the Southern Marin cities of Sausalito, Tiburon and Mill Valley, where vacancy rates were over 6% starting in midsummer of 2024. Owners are reporting that it is taking months instead of weeks to fill vacant apartments.

Many landlords are now lowering rents in order to fill units. Most of the rent growth in the past 3 years was due to tech workers moving from San Francisco to find cheaper housing.

Now with the tech lay offs in San Francisco, Marin landlords are seeing declining demand for Marin rental housing.

In Central Marin, where rental housing is cheaper and more abundant, rents are flat with the vacancy rate around 4%. Two thirds of rental housing units in San Rafael are filled with lower income tenants who work in the Marin County service industry.

The weak population growth in the County and higher rents will continue to affect rent growth in 2025 and rents are expected to be flat.

- Add in unit stacked washer and dryer to a closet off the living room. Property managers report this is the number one request from potential tenants looking for an apartment.

- Consider offering an incentive of $1,000 off the first month’s rent with a 12 month signed lease.

- Alter your no pet policy by allowing one pet per unit (either cat or dog) and asking for a pet deposit at move in. The most stable tenants often have pets and don’t move often, thus reducing your turnover costs.

- Add separate storage units for tenant use, even if it’s a portable unit at the rear of the property that is waterproof and easily accessible.

- Add bike racks for tenants at your property, especially where popular bike paths are nearby.

- Consider creating or upgrading existing outdoor spaces for tenants where they can relax with a book or socialize with friends or family. An outdoor table and chairs are popular with most tenants.

Editor’s Letter

Winter 2025 Marin Apartment Market

Let’s celebrate some wins this year! Local rent control proposals by the cities of Larkspur, San Anselmo and Fairfax were defeated at the ballot box in November 2024. This is significant because the draconian proposals would have added to the current restrictions on rent raises issued by the State with 5% annual raises coupled with the SF Bay Area CPI index.

Last year there was an 8.8% cap on rents, down from 10% the previous year. With increased operating costs (water, garbage, insurance and taxes) the prospect of having additional rent growth restrictions would have taken apartment property owners backwards, with less cash flow to cover operating costs.

At the same time, apartment owners in Marin have been faced with decreasing demand for rentals since mid-2024. As explained on the previous page, tech workers are getting laid off, many of them renters, forcing them to relocate out of the County.

This is not a permanent situation, but fluid and changing all the time. I think we are in an uncertain economic environment, and we will just have to wait and see how this plays out. In the meantime, we have apartment properties to buy, sell and manage and we are living in one of the most desirable places in the world.

If you are thinking of selling this year or trading up, I expect apartment inventory to increase, as it did last year, and many quality properties to be offered on the market. Last year many more investors entered the market as sellers retired from apartment management. We now have enough closed sales to demonstrate that buyers will only make offers on buildings that have a reasonable return (5% CAP) on properties that have near market rents and lower cap rates on buildings with significant upside in rents.

If you would like a no obligation evaluation of your apartment property, give me a call at 415-302-7730 or email me at katherine@khiggins.com.

Marin County Apartment Market Trends for Year End 2024

Apartment market sales of five units and above in Marin County increased 2.5 times over last year’s sales, totaling over $221 million in 2024.

Prices dropped on closed sales from 2023, with the median price per unit over $380,000 in 2023 dropping to a median price of $358,000 per unit in 2024.

Apartment inventory for sale increased as long-time owners looked to retire from apartment management, but only about 50% of those listed properties sold in 2024. Expect those properties to be back on the market in 2025 at reduced prices.

Apartment sales cap rates reached a median of 5.15% in 2024 rising from a median cap rate of 4.63% in 2023. The exception to cap rates is in the Southern Marin cities of Sausalito, Tiburon and Mill Valley, where cap rates can still be below 4% if there is considerable upside on rents at the property.

In 2025 I expect increased sales volume in both 2–4-unit multifamily properties and those with 5 or more units in 2025. Apartment interest rates are moving down, all be it slowly, and apartment investor demand is increasing with the lower closed sales pricing.

Marin County Apartment Sales 2024*

Recent Activity